Reporting and Withholding on Payments to Non-U.S. Persons

January 15, 2018 by Gordon Advisors

The end of the year is approaching and soon businesses will begin gathering information to report payments to contractors or non-employees, for their work and services during the year. It can be confusing when it comes to paying, withholding and reporting on foreign or non-U.S. persons.

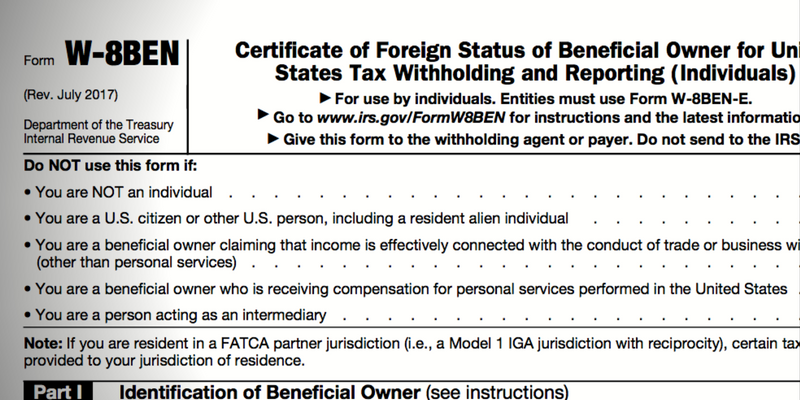

Getting The Information You Need Up-Front

It is typically much easier to get payees to comply with the paperwork requirements if you require them to be submitted before payment is ever made. Every new contractor or non-employee should complete and submit Form W8-BEN. This form provides the personal information to report payments if it is found to be needed, such as name, address, country of citizenship, tax ID number, and whether the individual is claiming tax treaty benefits.

Payments Subject to Tax

Non-U.S. or foreign persons, are subject to a 30% tax rate on U.S. income they receive, which is usually collected in the form of withholding. The following is a list of common forms of income to which withholding applies:

- Compensation for services

- Rents

- Interest

- Dividends

- Other fixed or determinable gains, profits or income

Cross border payments

If payments are made for work completed both inside and outside the U.S., only the payments made for U.S. work is required to be reported to the Internal Revenue Service. You must make every effort to segregate the payment between U.S. and non-U.S. income. Other governments may require reporting as well.

Who must withhold tax?

A withholding agent, corporation, partnership, individual or other entity, can be any person (U.S. or foreign), that has control of and is making the payment of U.S. sourced income.

How do I report?

The gross payment and withholding, if applicable, must be reported to the IRS on form 1042-S. These are due to the recipients by March 15th. The amount of tax being withheld, if applicable, determines the deposit frequency. This is similar to traditional payroll and contractor payments made to U.S. residents and citizens.

Consult a CPA

Businesses can encounter some confusion with payments to foreign individuals and businesses, especially in the Metro Detroit area, given its proximity to Canada. An experienced CPA can help answer your questions and assist you with the required reporting. Contact us today.